April 2024

The FinTech sector is booming. A portmanteau of “Financial Technology,” FinTech is driven by the goal of making financial services more accessible, efficient, and transparent by leveraging technology to create financial products that challenge traditional financial sector paradigms and regulatory frameworks. Fueled by the rapid advancement and adoption of technology such as AI, machine learning, blockchain, and cloud computing, the global fintech market is one of the fastest-growing sectors within the broader technology and financial services industries.

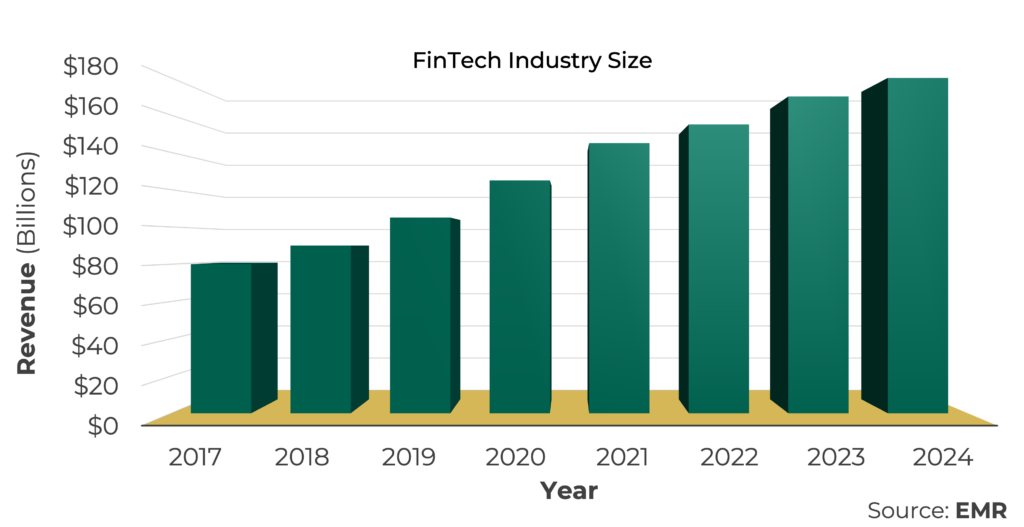

The global fintech market size reached approximately USD 226.71 billion in 2023. The market is projected to grow at a CAGR of 16.8% between 2024 and 2032, reaching a value of around USD 917.17 billion by 2032. [SOURCE: EMR]

Worth over $226 billion in 2023 and projected to reach a value of over $917 billion by 2032, a lot of the buzz is being generated by the over 26,000 FinTech startups currently worldwide (up from 12,000 in 2029). However, established financial institutions are also adopting FinTech solutions to improve and expand their offerings. The rapid growth of FinTech reflects its potential to democratize access to financial services. FinTech advancements have garnered support from governments worldwide through incentives and regulatory reforms as they recognize its potential to drive economic growth, improve financial inclusion, and enhance efficiency in financial services.

Payment and Money Transfer Services

Easy and fast payments and money transfers between individuals and businesses often bypassing traditional banking systems.

Cryptocurrency and Blockchain

Technology to facilitate secure, transparent financial transactions without the need for centralized banking authorities.

Digital Wallets

Software-based systems that securely store payment information and enable electronic transactions, both online and in physical stores, using digital devices such as smartphones or computers.

Robo-Advisors

Automated investment platforms that use algorithms to provide personalized financial advice and manage investment portfolios based on individual goals and risk preferences.

Peer-to-Peer (P2P) Lending/Microlending

Connect borrowers directly with individual lenders, streamlining the lending process and often offering more favorable terms than traditional banks.

Insurance Technology (InsurTech)

Use AI and machine learning to disrupt traditional insurance models, offering faster claims processing and more personalized insurance policies.

Regulatory Technology (RegTech)

Help financial services companies comply with regulations efficiently and at lower costs through big data and machine learning to monitor transactions and report suspicious activities.

Personal Investment Management

Apps that help individuals manage their investment portfolios, often linking directly to their bank accounts and credit cards.

Mobile Banking

Challenger banks and neobanks offer mobile apps that allow customers to perform banking activities such as transferring money, depositing checks, and applying for loans directly from their smartphones.

Crowdfunding

Platforms enable individuals and companies to fund projects or ventures by raising small amounts of money from a large number of people, often through the Internet.

Digital Identity Verification

Technologies that enable secure and quick identity verification online, facilitating everything from account creation to compliance checks.

Nearshore Advantages for FinTech

The total addressable market for companies in this space is huge, which means they require vast customer management solutions. Increasingly, FinTech companies are turning to nearshore outsourcing due to several key advantages they offer, particularly when looking to optimize operations while maintaining high levels of service quality and technological innovation. Beyond the well-known benefits of nearshore outsourcing, such as proximity, cost efficiency, and access to a skilled workforce, below are some of the key differentiators that make nearshore BPOs so well-suited to support FinTech companies.

-

- Cultural Alignment: Cultural alignment is critical when outsourcing for FinTech. Nearshore BPO agents are more exposed to and better equipped to understand the FinTech company’s products, market, and customers. This leads to more tailored and effective solutions that meet the industry’s unique needs and challenges.

-

- Technological Affinity: Many nearshore BPOs have a strong focus on adopting the latest technologies and are well-equipped to support FinTech companies with advanced IT infrastructure, cybersecurity measures, and innovative solutions like AI and machine learning. This technological affinity enables FinTech firms to maintain a competitive edge both internally and externally.

-

- Regulatory Compliance and Data Privacy: Nearshore BPOs are aligned with and adhere to the regulatory environment and data protection laws similar to those in the client’s country. This is particularly important for FinTech firms that operate under strict regulatory standards and need to ensure compliance across borders.

-

- Risk Mitigation: Working with nearshore BPOs can help mitigate operational and financial risks associated with expanding into new markets or scaling operations. The geographic proximity and similar legal frameworks can make it easier to manage and resolve any issues that arise.

-

- Flexibility and Scalability: Nearshore BPOs can offer FinTech companies the flexibility to scale their operations up or down based on demand. This agility is crucial in the fast-paced FinTech industry, where companies need to rapidly adapt to market changes, regulatory shifts, and technological advancements.

- Enhanced Customer Experience: The proximity and cultural affinity of nearshore BPOs can lead to a better understanding of customer needs and preferences, resulting in improved customer service. For FinTech companies, where trust and customer satisfaction are paramount, this can significantly impact customer retention and brand loyalty.

In summary, nearshore BPOs offer a perfect blend of cost efficiency, technical affinity, risk mitigation, and regulatory understanding, which aligns perfectly with the needs of modern FinTech companies. By partnering with a reliable, technologically advanced, and strategically located nearshore BPO, FinTech firms can focus on their core competencies, such as product development and innovation. A successful nearshore partner will complement FinTech growth strategies through exceptional customer experiences and by leveraging key technologies to ensure friendly and efficient transactions as an extension of their brand.

KM² Solutions, with its rich history, extensive experience in the financial services sector, and being one of the most technologically advanced and forward-thinking companies in the nearshore space, is ideally positioned to support FinTech companies looking to outsource non-core functions. KM² provides high-quality customer care, live chat, helpdesk, and level-1 tech support from six top-tier locations in the Caribbean and Latin America. It offers multilingual support and ample redundancy through its broad geographic footprint, making it the perfect nearshore partner for FinTech companies with a focus on the future.

About KM² Solutions

KM² Solutions ( KM2 Solutions ) is an award-winning BPO with over two decades of experience operating an exclusive nearshore strategy throughout the Caribbean and Latin America. KM² provides outsourced inbound and outbound customer service contact services for voice, chat, email, and mobile to clients in financial services, multi-unit healthcare, insurance services, travel & hospitality, eCommerce, technology & telecommunications, home services, and other sectors. The company provides clients with a host of solutions, including customer support and care, telesales & retention, claims management & processing, appointment setting & schedule management, loan origination & verifications, back-office processing, and technical support. KM² Solutions maintains PCI DSS compliance, completes an annual SOC 2 audit, and has a Compliance Management System that meets the FDIC standards.