December 2025

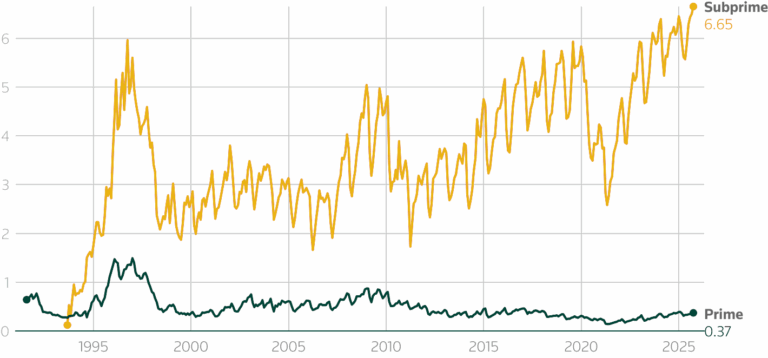

Auto loan delinquencies in the United States are rising faster than expected, with subprime borrowers under the greatest pressure. In October, Reuters reported that the share of subprime borrowers at least 60 days behind on their auto loans climbed to 6.65 percent, the highest level on record since the early 1990s. For prime borrowers, Reuters noted that the 60-day delinquency rate held steady at 0.37 percent, unchanged from both the previous month and the prior year. The widening gap between prime and subprime highlights how concentrated, yet severe, the emerging stress has become.

Subprime Borrowers Fall Behind on Auto Loans

Subprime auto loans at least 60 days past due rose to 6.65% in October, according to data from Fitch Ratings.

Source: Reuters via Fitch Ratings

Industry data shows that auto-loan performance has softened over the past decade, with the most pronounced weakness appearing in subprime segments. Prime performance has remained comparatively stable, but subprime delinquency rates have climbed steadily, signaling that financial stress has been building for years rather than emerging suddenly. As subprime pressure compounds across multiple credit cycles, the workload required to manage delinquent accounts tends to rise and remain elevated.

Why Delinquencies Are Rising

The increase is driven by several pressures that have been building for years. Vehicle prices surged between 2020 and 2023, and, according to Experian, the average monthly car payment for new cars is $749, while used cars average $529. High loan-to-value ratios leave consumers with almost no flexibility. Longer loan terms make it worse. Many contracts now run 72 months or more, keeping borrowers underwater and limiting their ability to absorb financial shocks. Rising insurance and maintenance costs add more strain. Premiums are up nationwide, repair costs continue to climb, and older vehicles need more frequent servicing.

Wage growth has not kept pace with cumulative inflation, and pandemic-era savings have disappeared. Households are carrying higher credit card balances, BNPL obligations, rent increases, and unexpected medical bills. Used-vehicle values have become more volatile, and price corrections can reduce auction proceeds and put upward pressure on loss severity. These pressures weaken repayment capacity and push more accounts into delinquency. Looking ahead, proposed tariff changes and broader market shifts could lift vehicle prices again. Higher transaction prices historically mean higher monthly payments. Additional tariff-driven increases in consumer goods would tighten household budgets even further, raising delinquency risk across multiple credit lines and adding more pressure to internal servicing teams.

“Household debt continued to rise, and credit card and auto loan transition rates into delinquency increased.”

What This Means for Auto Finance Clients

Rising delinquencies create more work than most lenders expect. Early-stage accounts grow first, and these accounts require more reminder calls, more outreach attempts, more promise tracking, more inbound handling, and more resolution activity. A single delinquent borrower produces a long list of follow-up work. This includes contact attempts, documentation, account updates, payment discussions, arrangement reviews, and the QA and compliance steps that support them. As volumes increase, these tasks multiply quickly, and internal teams can struggle to keep up.

This operational pressure also raises financial risk. Higher delinquency levels affect portfolio performance and change how investors view overall stability. Loss severity increases as auction values fall. Cure rates slip when outreach is delayed or inconsistent. The lenders that get ahead of rising volumes by adding capacity early are the ones that maintain performance. The cost of waiting is high. The cost of trying to recover late is even higher.

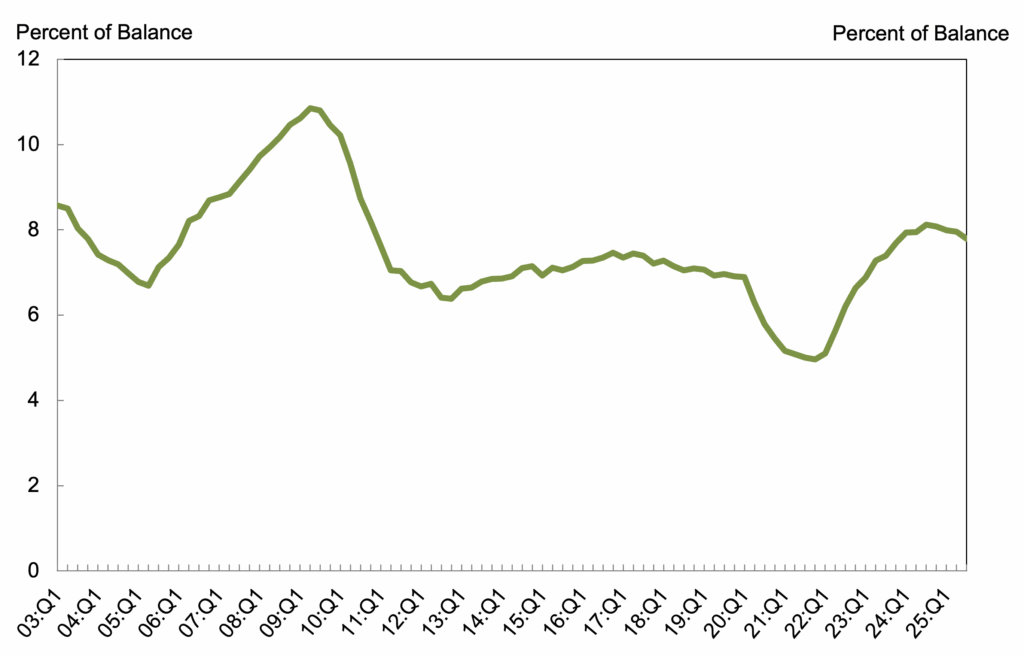

Auto Loan Transition Into Serious Delinquency (30+ Days)

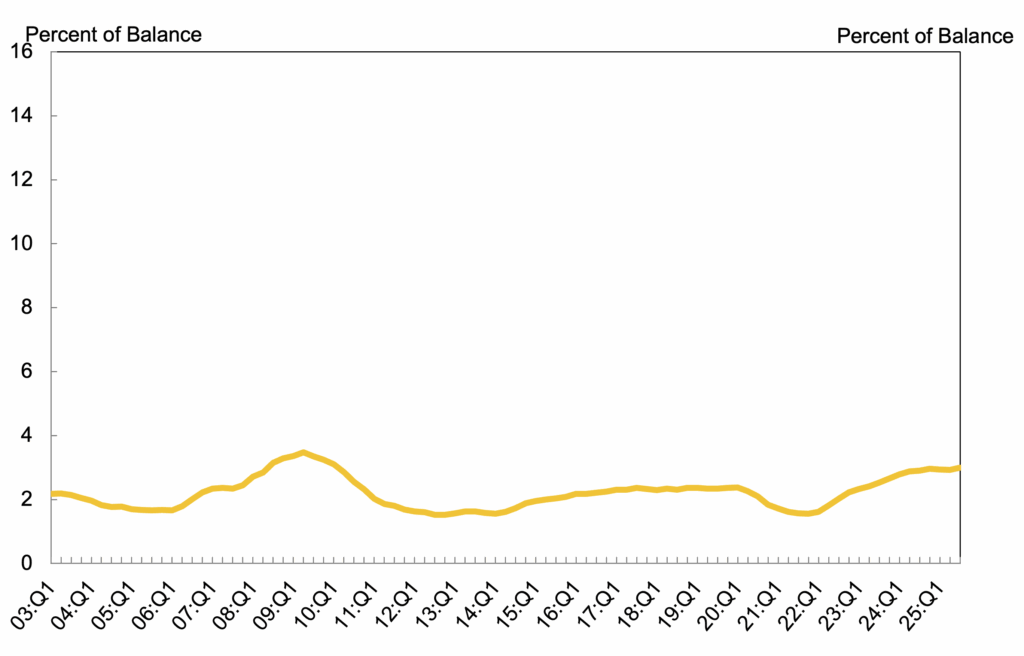

Auto Loan Transition Into Serious Delinquency (90+ Days)

How This Impacts BPO Strategy

This environment reshapes how lenders think about servicing capacity. Higher delinquency levels can overwhelm internal staffing models, especially when domestic hiring remains slow, costly, and constrained by tight labor markets in key auto finance regions. Training cycles add more delay. As a result, internal capacity on its own cannot keep pace with the volume created by a growing delinquency curve.

Nearshore outsourcing gives lenders the flexibility and coverage they need. Scalable teams support early-stage outreach, payment plan discussions, and first-party collections. They increase right-party contact rates. They keep follow-up consistent. They handle hardship requests and extension activity. They protect cure rates and reduce the number of accounts rolling into later stages. Nearshore capacity gives lenders the room to operate when delinquency trends move quickly, and internal staffing cannot keep up.

“Existing teams and systems are stretched to their limits, struggling to manage the growing volume of at-risk accounts.”

Source: CR Software Blog

The KM² Advantage

KM² Solutions supports lenders across the full credit lifecycle, from first-party outreach to early-, mid-, and late-stage collections, along with the back-office functions that keep portfolios current. Our teams operate within client-defined workflows, follow established documentation standards, and maintain strong QA and governance so every interaction meets lender and regulatory expectations. We provide the structure, accuracy, and consistency needed to manage rising volumes without disrupting day-to-day operations or diverting internal resources.

Our nearshore model strengthens operational resilience. Lenders gain access to trained teams, stable labor markets, and scalable capacity without the delays and cost of domestic hiring. We expand coverage as portfolios shift, protect cure rates during peak periods, and keep follow-up consistent when delinquency trends accelerate. With early-stage volumes rising, and tariff-driven cost increases likely to add more pressure, internal teams will feel the strain quickly. The lenders that reinforce capacity now will maintain performance later, and KM² is ready to help them stay ahead.

About KM² Solutions

KM² Solutions ( KM2 Solutions ) is an award-winning BPO with over two decades of experience operating an exclusive nearshore strategy throughout the Caribbean and Latin America. KM² provides outsourced inbound and outbound customer service contact services for voice, chat, email, and mobile to clients in financial services, multi-unit healthcare, insurance services, travel & hospitality, eCommerce, technology & telecommunications, home services, and other sectors. The company provides clients with a host of solutions, including customer support and care, telesales & retention, claims management & processing, appointment setting & schedule management, loan origination & verifications, back-office processing, and technical support. KM² Solutions maintains PCI DSS compliance, completes an annual SOC 2 audit, and has a Compliance Management System that meets the FDIC standards.